The Impact of Artificial Intelligence in Accounting and Auditing

Accounting and Auditing are two more areas that are being revolutionized by artificial intelligence (AI). There is potential for improving decision-making processes in various domains via the incorporation of AI. This blog article examines how artificial intelligence (AI) works in Accounting and Auditing and the advantages, difficulties, and prospects of this technological advancement.

What Does Artificial Intelligence Mean for Accounting?

The main goal of artificial intelligence (AI) technology is to mimic human input and thinking via the use of software and algorithms. Artificial Intelligence in Accounting is mainly used for two primary purposes.

AI can first evaluate financial facts. AI-powered technologies may then analyze large datasets, providing insightful analysis of past patterns and useful future projections for businesses.

Second, using AI accounting software can automate tedious chores like overseeing AP and AR procedures and monitoring bills. Accounting procedures can now be completed much more quickly and accurately than in the past.

Understanding AI in Accounting

Artificial intelligence (AI) is the replication of human cognitive functions on a computer platform, such as voice recognition and expert systems. AI significantly impacts the accounting industry because of its ability to automate a wide range of processes, recognize trends, spot impacted activity, provide reports, and issue invoices. This helps the accounting firm be timely and impress clients along the way.

AI offers numerous benefits for your company. It can help integrate various corporate regulations and quickly identify problems or fraud. For instance, AI can check employee spending for transactions that go against corporate rules. This approach makes Auditing less repetitive, allowing the auditors to focus on more important matters.

One of the main benefits of Artificial Intelligence in Accounting is its ability to complete data input and analysis more quickly and effectively. Data input is one of the most challenging and time-consuming tasks that accountants have to do. Additionally, AI can handle tasks like filling a report with all the data required for a certain client.

AI is also capable of producing a company's budget prediction. It forecasts the company's financial future by analyzing historical economic data. Gathering pertinent data and generating tax return reports may help prepare the company's taxes.

Because AI mimics human intellect and can learn specific jobs instinctively, it has several advantages over conventional software packages. A software package, on the other hand, is a program created to do one or more specific functions.

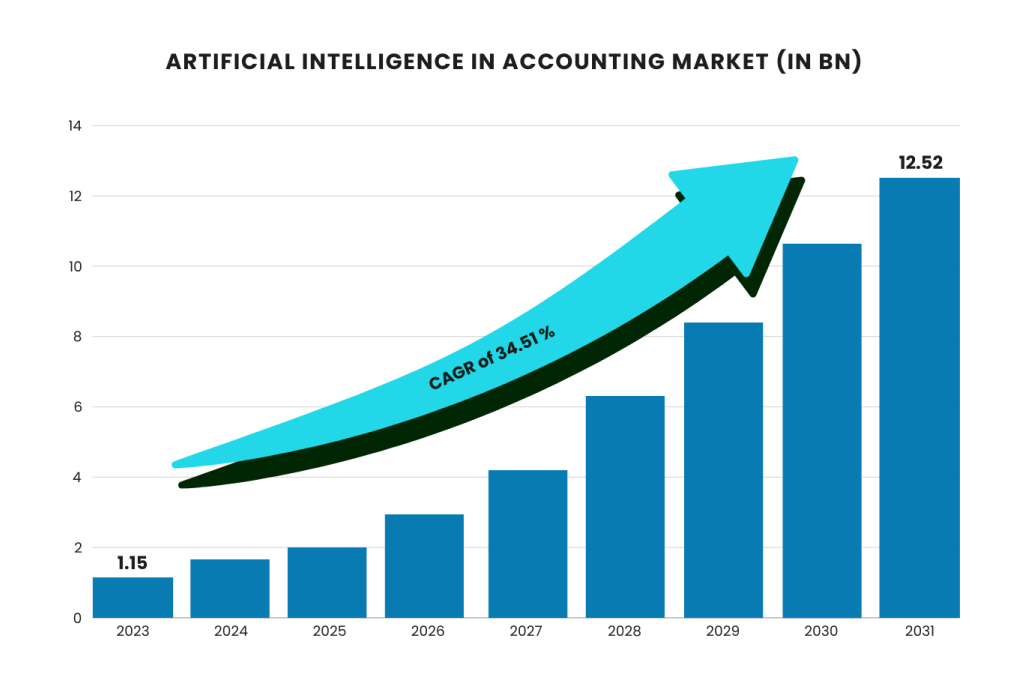

Stats for Artificial Intelligence in Accounting and Auditing

- 82% of accounting professionals believe AI will be necessary to keep up with work demands by 2025.

- AI has the potential to automate 80% of manual accounting tasks.

- 94% of CFOs believe AI will be a key driver in enhancing efficiency in finance and accounting departments.

- AI adoption in accounting is expected to see a CAGR of 42.5% from 2020 to 2027.

- Over 50% of accounting tasks can be automated using AI and machine learning technologies.

- Two-thirds of accounting firms are actively investing in AI technologies.

- AI-powered chatbots can handle up to 80% of routine accounting queries.

- AI can reduce the time spent on data entry tasks by 50%.

- 87% of finance professionals agree that AI can save time in routine tasks like data processing.

What Artificial Intelligence Auditing Is Defined As?

AI auditing is the study and practice of evaluating, minimizing, and ensuring the safety, ethics, and legality of algorithms. It involves extensive audits that cover every stage of the system's life cycle, including test datasets, development team evaluation, reporting business case justification, and more. Depending on the system's degree of access, they may additionally need access to the inputs and outputs as well as details about the inner workings of the model.

AI auditing is a process that evaluates a system, identifies the risks associated with its technical functioning and governance structure, and suggests countermeasures.

AI's Impact on Accounting

Automating Typical Tasks

One of AI's most important effects in accounting is automating repetitive processes. AI-powered solutions need less human interaction to manage data input, invoice processing, and reconciliation. This decreases the mistakes related to manual processing and cuts down on time spent on tedious chores.

Improved Information Extraction

AI systems can process large volumes of data rapidly and reliably. This translates to better data analysis skills for accountants, allowing them to provide insights that were previously hard to find. AI may analyze financial data to find patterns, trends, and anomalies. This information is helpful for strategic planning and decision-making.

Instantaneous Financial Tracking

AI-powered solutions make real-time account and transaction monitoring possible. This ongoing supervision aids in the early detection of disparities, potential fraud, or financial irregularities. AI technologies provide accountants with immediate notifications, enabling them to handle problems before they become worse.

Analytics for Predictive

AI's predictive analytics capabilities are revolutionizing financial planning and budgeting are revolutionizing financial planning and budgeting. AI systems can forecast future financial patterns by evaluating past data, enabling organizations to make well-informed choices. This includes projecting financial flow, costs, income, and even possible investment possibilities.

The Use of AI in Accounting Nowadays.

The accounting profession has historically focused on laborious computations, precise number-crunching, and duties motivated by compliance.

AI is ushering in a new era where accountants can focus on higher-value, strategic tasks, while AI-powered tools handle the repetitive, rule-based tasks. This shift empowers accountants, giving them more control and confidence in their roles.

AI in accounting software streamlines financial procedures and reduces the chance of human error, from automated data input to real-time financial analysis. These are just a few examples of how AI enhances efficiency and productivity in accounting.

Effective Handling and Balancing of Invoices.

Accounting AI integration with e-invoicing is predicted to save up to $28 billion in the next ten years.

Consider the number of hours an accounts payable staff member spends balancing invoices and transactions. AI technology, especially optical character recognition (OCR) and machine learning algorithms, significantly reduces this time, making the process more efficient and productive.

AI technology, especially optical character recognition (OCR) and machine learning algorithms makes invoice processing much more efficient.

OCR reads invoices and extracts pertinent data such as amounts, line items, dates, and invoice numbers. AI classifies transactions automatically based on previous use.

Transactions are automatically coded, categorized, and entered into the GL without human labor. This shortens processing times overall and lowers the possibility of human error by eliminating the necessity for manual data input.

AI accounting software facilitates the process of connecting related invoices and financial transactions throughout the reconciliation process. Using pattern recognition and data analysis, AI systems can quickly detect anomalies and outliers. These systems may then flag these items for further examination by human accountants.

This reduces the possibility of error and speeds up the reconciliation process while simultaneously improving accuracy.

Artificial intelligence (AI) essentially converts laborious manual activities like invoice processing and reconciliation into automated, precise, and efficient accounting procedures that support overall financial integrity and transparency.

Automated Reporting of Expenses.

Completing expenditure reports is a task one enjoys. Technology may now take over that chore that is often put off.

To use Airbase, you snap a picture of the receipt using the mobile app or send it via a specific receipt inbox. Airbase then uses the most recent OCR technology to populate the expenditure request information automatically. Built-in ML extracts the necessary data, such as the GL category, date, amount, and vendor, and generative AI fills in the gaps using historical trends.

Our investigation reveals that not having to submit time-consuming expense reports saves workers an average of 46 hours annually! Touchless cost reporting unlocks proven time savings!

Fraud detection.

AI is significantly quicker than humans in analyzing large volumes of data.

Accounting experts may identify minor indicators of fraudulent conduct that may go unnoticed by the public by using their abilities to examine financial data from several sources at once, such as transaction history, user behavior, and external data feeds. It is possible to flag suspicious transactions for further examination quickly.

Because AI has been taught about past fraud instances, its ability to identify fraud constantly improves.

Forecasting and Budgeting.

AI in FP&A enables data-driven decision-making and facilitates accurate and agile navigation of complicated financial predication for enterprises.

By evaluating base datasets, Artificial Intelligence (AI) may provide valuable insights into competitive landscapes, market circumstances, and other variables that impact planning and strategy.

Machine learning algorithms examine past data to find trends and factors, making more precise forecasting possible. This capacity for prediction helps with accurate risk assessment and scenario planning.

AI-driven automation also automates manual, repetitive accounting processes like data input and report production, freeing up the FP&A team to concentrate on strategic analysis.

Record Intelligence.

AI can quickly recognize important information from order forms and SOC documents to increase accuracy and save time. When integrated into intake procedures, AI pulls essential information, including price details, auto-renewals, and conditions of payment. Generative AI prefills all of Airbase's purchase information and GL linkages to save laborious data input.

AI may also scan SOC papers to identify and highlight probable exceptions and tested rules, helping approvers rapidly analyze and handle relevant purchase requests within current procedures.

Back-End Operations.

The administrative and support duties essential to a business's operations, such as data entry, processing, payroll, and compliance, are referred to as back-office responsibilities. AI automates these monotonous processes to save time.

However, using continuous learning from past data, AI presents a paradigm change beyond simple job automation in back-office activities.

These systems adapt to manage complex activities that usually require human involvement. AI, therefore, reduces the inherent chance of mistakes in manual labor, improving the general accuracy and productivity of back-office company operations worldwide.

Organizations gain from decreased dependence on repetitive human labor, simplified processes, and improved ability to manage complex and changing business settings by using AI's capacity to learn from experience.

Automating Duties Related To Accounting.

AI is capable of handling a wide range of bookkeeping and accounting activities, including:

- Sorting through transactions.

- Balancing the transactions.

- Entering data, including taking information off of invoices and receipts.

- We are locating inconsistencies and mistakes in financial data.

It's often believed that artificial intelligence (AI) would advance the accounting field by providing more time for value-added, more fulfilling work. Therefore, employment opportunities for accountants and auditors would remain the same.

Conversely, work prospects for bookkeepers could be more favorable. By concentrating on honing soft skills like critical thinking, problem-solving, and effective communication, bookkeepers may safeguard their career path and set themselves apart in human-touch professions like client engagements and strategic financial advising services.

Gaining proactive knowledge on how to use AI technologies in one's skill set can only increase job security.

Artificial Intelligence in Auditing

Enhanced Precision and Effectiveness

AI dramatically improves efficiency and accuracy in Auditing. Sampling is a common practice in traditional auditing methodologies. However, it might overlook essential concerns. On the other hand, AI is able to examine whole datasets, guaranteeing a thorough examination of financial documents. This comprehensive study lowers the possibility of oversight and improves audit quality overall.

Fraud Identification

The capacity of AI to recognize abnormalities is instrumental in locating fraudulent activity. AI systems are able to identify suspicious activity and flag it for further inquiry by continually monitoring financial transactions and comparing them against pre-established patterns. This proactive strategy aids in preserving the accuracy of economic data and reducing the danger of fraud.

Observance and Management of Risk

Adherence to several laws and standards is part of Auditing. AI can speed this process by automatically updating compliance checklists and regularly monitoring changes in regulations. This lowers the chance of non-compliance and the fines that go along with it by ensuring that audits stay in line with the most recent regulations.

Improved Planning for Audits

AI has the potential to help auditors plan their audits more efficiently. Artificial Intelligence (AI) may assist auditors in more effectively allocating their efforts by evaluating past audit data and pinpointing high-risk regions. This focused strategy increases audit efficacy and guarantees that important areas get the attention they need.

AI in Audit: A Step-by-Step Exam

The field of Auditing is undergoing a dramatic change due to artificial intelligence (AI). One significant invention that has the potential to change the auditing process from the beginning stages of planning to the end is artificial intelligence (AI). Let's examine how each stage of the audit lifecycle is impacted by artificial intelligence:

Planning and Risk Assessment

Artificial Intelligence algorithms examine facts, industry standards, and legal obligations. They can identify high-risk regions inside a company. Thanks to this data-driven method, auditors may customize their audit plan by focusing efforts on the most fundamental control areas.

Data Extraction and Analysis

Just picture bidding adieu to repetitive data entry. AI solutions can automate data categorization and extraction from various sources, such as email data sets, financial systems, and ERP software. This saves auditors a great deal of time and effort and lowers the possibility of mistakes. AI is also capable of sophisticated data analytics, which might reveal hidden relationships and possible alerts that need further investigation.

Constant Testing and Monitoring

One clear benefit is real-time monitoring. Over time, AI-powered solutions can reliably screen critical controls and transactions. This makes it possible to spot possible control flaws or anomalies early on. Imagine being able to identify a potential fraud plan before it had a chance to do significant damage. Auditors may negotiate and settle disputes before they become significant ones by checking often.

Normalization and productivity are the main benefits of audit documentation and reporting. AI may summarize findings and highlight essential insights to automate standardized audit reports. This allows auditors to concentrate on crafting more perceptive management suggestions and narratives. AI may also analyze findings from several engagements to identify patterns and trends, which might inspire more research into future audit planning and risk evaluations.

AI's Advantages in Accounting and Auditing

Time and Money Savings

The automation of repetitive processes and the effectiveness of AI-powered systems benefit businesses significantly in terms of time and expenses. Instead of being mired by laborious procedures, accountants and auditors may concentrate on higher-value tasks like strategic planning and advising services.

Enhanced Precision and Dependability

AI decreases the possibility of human error in financial procedures. The accuracy and dependability of AI systems facilitate better decision-making and more confidence in economic data, which also improves the overall quality of financial records and audits.

The Ability to Scale

Because AI technologies are so scalable, accounting and Auditing procedures may expand along with the company. Artificial intelligence (AI) systems can manage the extra effort as transaction volumes rise without sacrificing accuracy or efficiency.

Improving Decision-Making

Predictive analytics and AI-driven data analysis provide organizations with the information they need to make wise choices. This entails spotting chances for expansion, controlling hazards, and enhancing financial results.

Challenges with AI Integration in Accounting and Auditing

Data Accessibility and Quality

High-quality data is essential for AI systems to operate efficiently. However, it might not be easy to guarantee that complete and accurate financial data is available. Data quality may undermine AI's advantages, resulting in accurate insights and choices.

Costs of Implementation

Considerable infrastructure and technological investment are needed to integrate AI into accounting and auditing procedures. It might be difficult for small and medium-sized businesses (SMEs) to cover these expenses, which could restrict their capacity to use AI.

Legal and Ethical Issues to Consider

AI applications in financial operations raise moral and legal issues. Concerns such as data privacy, responsibility, and openness must be addressed for AI to be used responsibly. Regulations must also change to keep up with technology's rapid progress.

Deficits in Competencies

The use of AI means that auditors and accountants must learn new techniques. This entails comprehending data analysis, AI-generated insights, and AI technology. Ongoing education and training are critical to closing skill gaps and optimizing AI's advantages.

AI's Role in Accounting and Auditing Going Forward

Persistent Progress

Ai's capacity for accounting and Auditing will grow as it develops. This includes more automation, better predictive analytics, and more complex data analysis. These developments will provide more significant insights and significantly simplify financial procedures.

Combination with Different Technologies

Combining AI with other cutting-edge technologies like blockchain and the Internet of Things (IoT) holds promise. For example, integrating blockchain technology with AI may improve the security and transparency of financial transactions, and real-time data from IoT can be used to monitor finances more precisely.

A Rise in Adoption

As companies become more aware of AI's advantages, more of it is anticipated to be used in accounting and Auditing. More prominent companies will probably set the example, but as AI becomes cheaper and easier to use, SMEs will also progressively embrace it.

The Evolution of Regulations

Legislative frameworks will continue to change to accommodate artificial intelligence's benefits and problems. This entails setting guidelines for data protection, using AI ethically, and following financial rules.

Conclusion

AI is improving accuracy, efficiency, and decision-making in accounting and Auditing. Even if there are obstacles to overcome, integrating AI has several advantages. As technology develops, AI will become increasingly important in determining financial procedures. In an always-evolving company environment, accountants and auditors may promote innovation, enhance economic performance, and guarantee compliance by integrating AI.

FAQs

Will AI replace Auditing?

Artificial intelligence is revolutionizing the accounting sector by automating tedious procedures and optimizing activity.

On the other hand, human auditors should be confident that their positions will be updated in the future. They are still essential for understanding the moral ramifications of AI and Auditing. Machine learning cannot replace the in-depth knowledge auditors must possess of their customers' businesses and industries.

In what ways will artificial intelligence (AI) enhance the auditing process?

An innovative technological advancement for the accounting sector is the partnership of AI and auditing experts.

AI-enhanced audit procedures will provide more specific and confident results by being more thorough and efficient.

Which auditing applications use AI?

One method of using AI in Auditing is to use data extraction tools with AI capabilities in combination with accounting practice management software. By automating data input and analysis, busy auditors may save time and minimize human mistakes.

Raju Ram Khakhal

Raju Ram has 10 years of experience in the IT industry as a web developer and leading mobile app development since 2012. He believes in sharing his strong programming knowledge base with a leaned concentration.

Subscribe Us

Join fellow entrepreneurs! Get Mtoag' latest articles straight to your inbox.